GST Ready POS Software

On July 1, 2017, government of India introduced a completely new taxation system for all businesses. At Hyper Drive we provide you business management solutions and hence we have come up with significant modification in all our business management products to help you implement GST.

There are some areas of GST tax return filing which fall out of scope of our product functionality. And there are other area which we implement with various detail levels in our products.

In this article we will try to explain to you how our products implement various aspects of GST. Please note that our discussion here is purely based on our product functionalities and how it works with regards to GST implementation. This article is not about comprehensive explanation of GST, for complete understanding of GST taxation and how to implement it perfectly for your business you will need to consult your tax advisor.

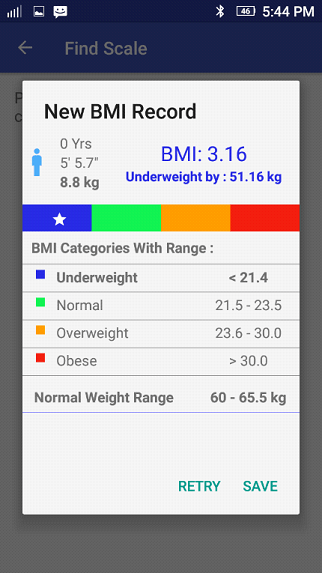

Our products provide you with three options for GST implementation.

- NO GST: This option is specifically for our international customers or any other customers who wish to not specify any data in the system specific to India GST.

- GST compliance warnings: This option allows you to continue to do your transactions even if they are not exactly filling the GST guidelines. Our system will warn you in such events but will still allow you to continue with your transactions. ( this is the default setting).

- GST compliance errors: If this option is selected you will not be able to complete any transactions that will not fulfill basic GST requirements.

Our business products “HDPOS smart Billing Software” will help you implement GST in the following ways

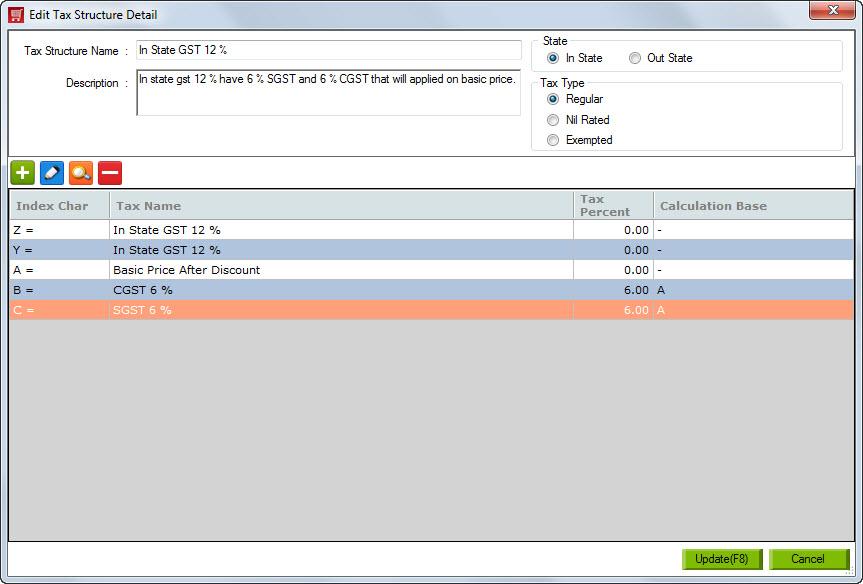

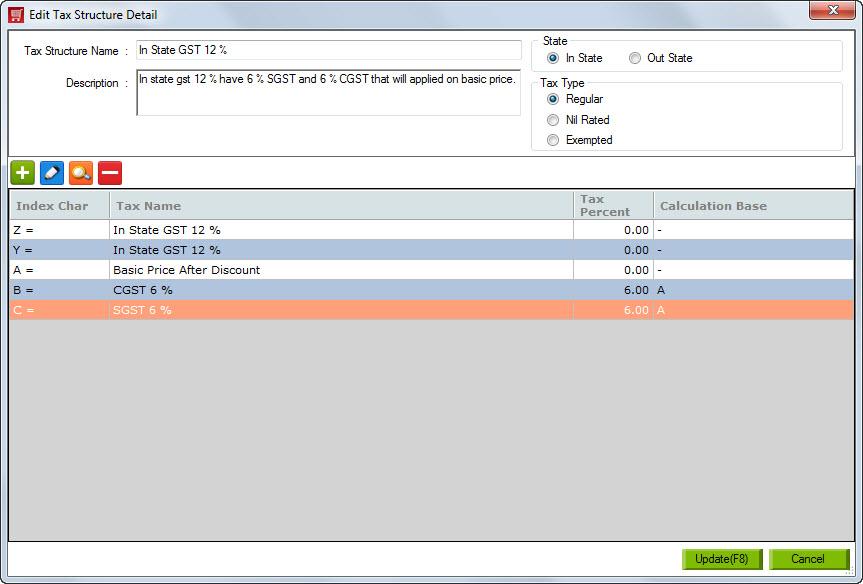

Defining Tax structures as per GST settings

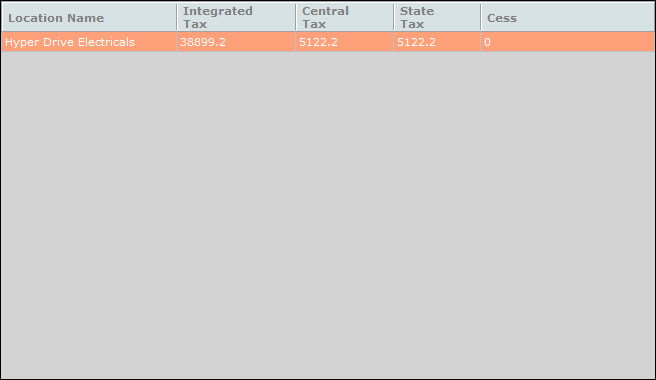

Government of India requires you to do the financial transactions in different ways when you are in-state business transactions versus when you are doing out of state business transactions.In other words while making sales to a customer within your state you need to collect CGST and SGST as sales tax from that customer versus if the customer was in a different state than your state you need to collect IGST from the customer as sales tax. Further you need to report this tax collection appropriately to the government at the end of every month. This task of collecting different types of taxes and doing the correct tax reporting can little daunting and overwhelming.

In order to make this tax definition and collection easier for you we have provided a mechanism in our application which will allow you to create most commonly used tax structures in a single click. You can go to our tax management window and click on “Create default tax structures”.

Once these tax structures are defined you need to consult your tax advisor to find out what tax brackets the items you are doing business with fall under. With that knowledge our applications will make it very simple for you to make India GST compliance invoice.

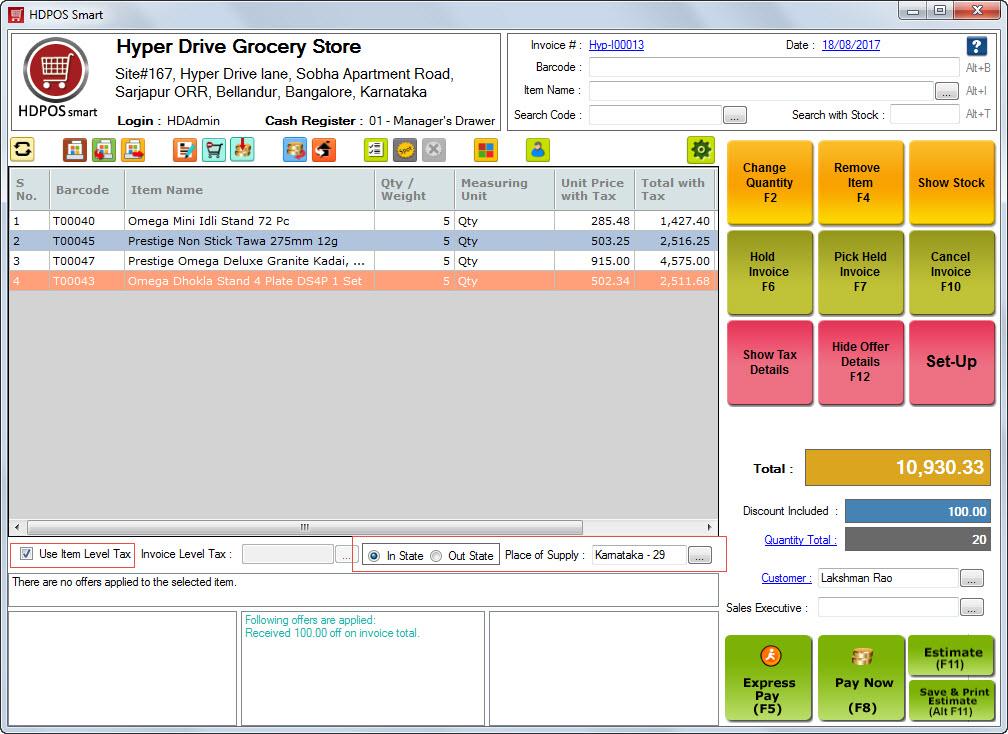

Managing In-state and Out-State transactions

For GST implementation Govt. of India has assigned a unique numerical number to each of the geographical states and it is mandatory under GST to specify these state codes as place of supply during all your purchases and sales activities.

In order to help you implement this correctly all your business locations, your customer addresses and your supplier addresses now has a data field “Place of Supply”. You will need to enter correct state and its code as specified by GST, by government of India

If you are doing any out of state business you can choose to configure our products to not ask you for ay out of state related data entry. This will help you reduce your data entry complexities and training requirements.

If you are doing in-state as well as out of state business you will need to enable settings in the configuration of our application which will allow you to specify out of state transaction related data.

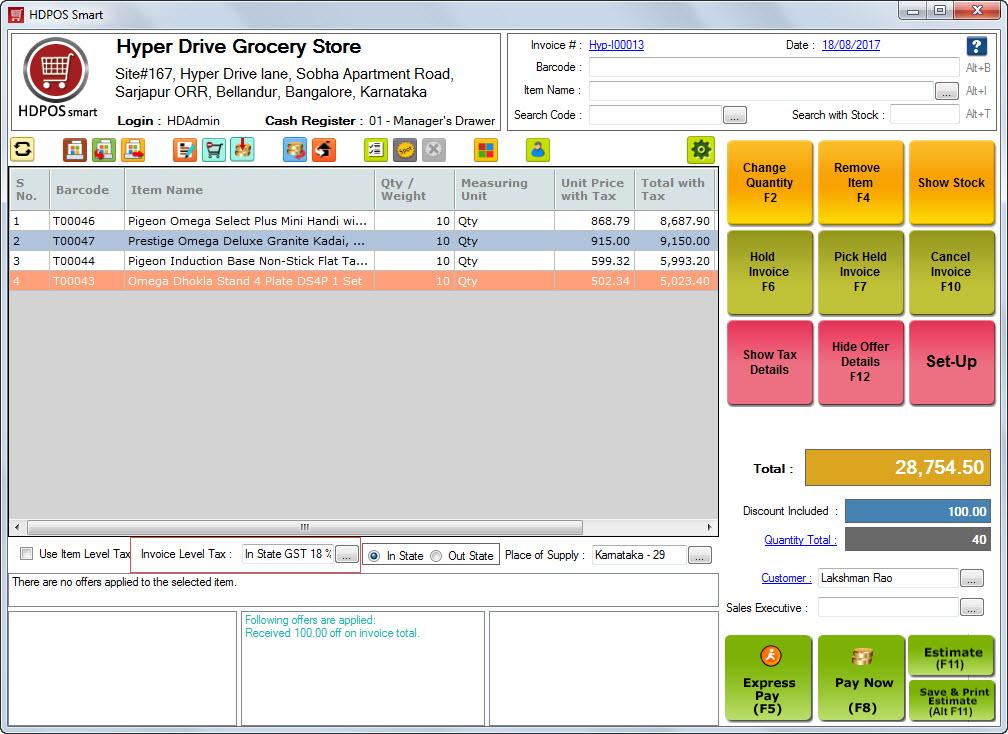

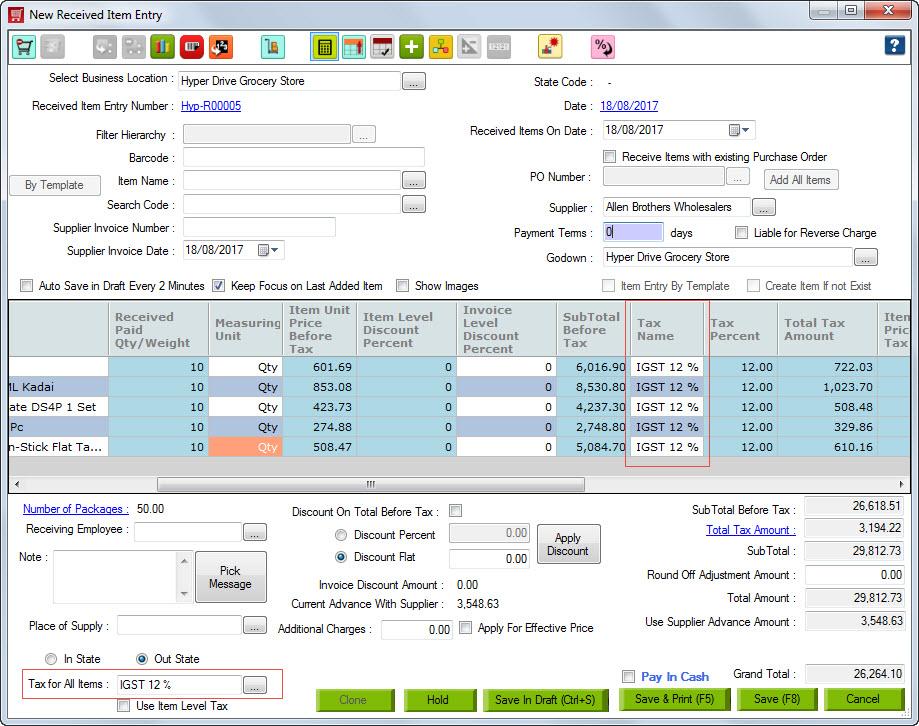

Choosing the correct taxation while making In-State / Out-State sales invoices and purchase entries.

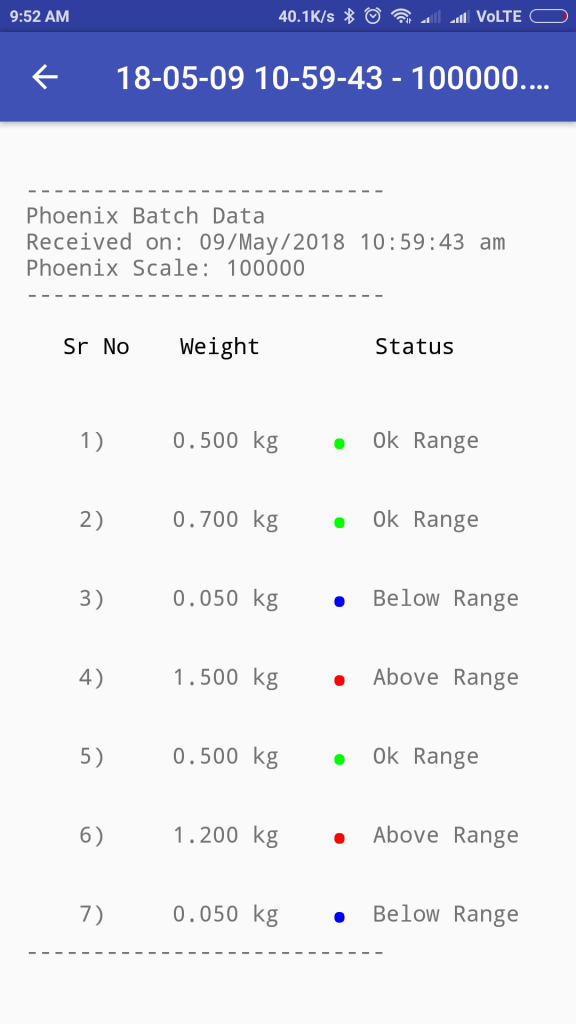

GST has specified different taxations for transactions that are done within the state and out of state. Our applications allow you to choose the correct taxations with the following options.

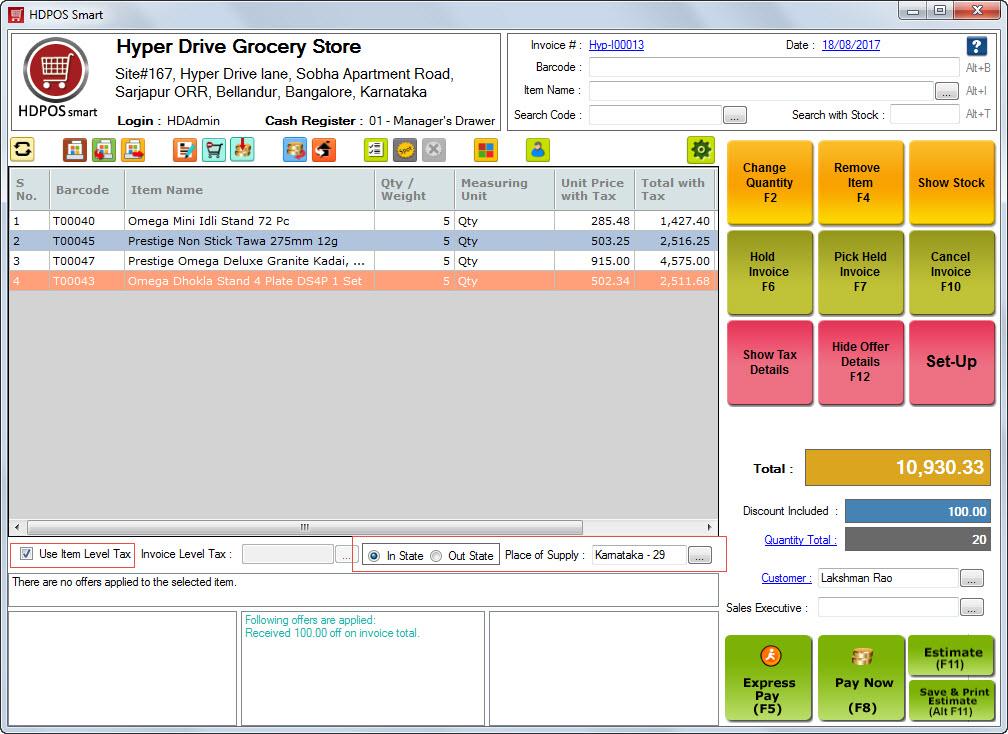

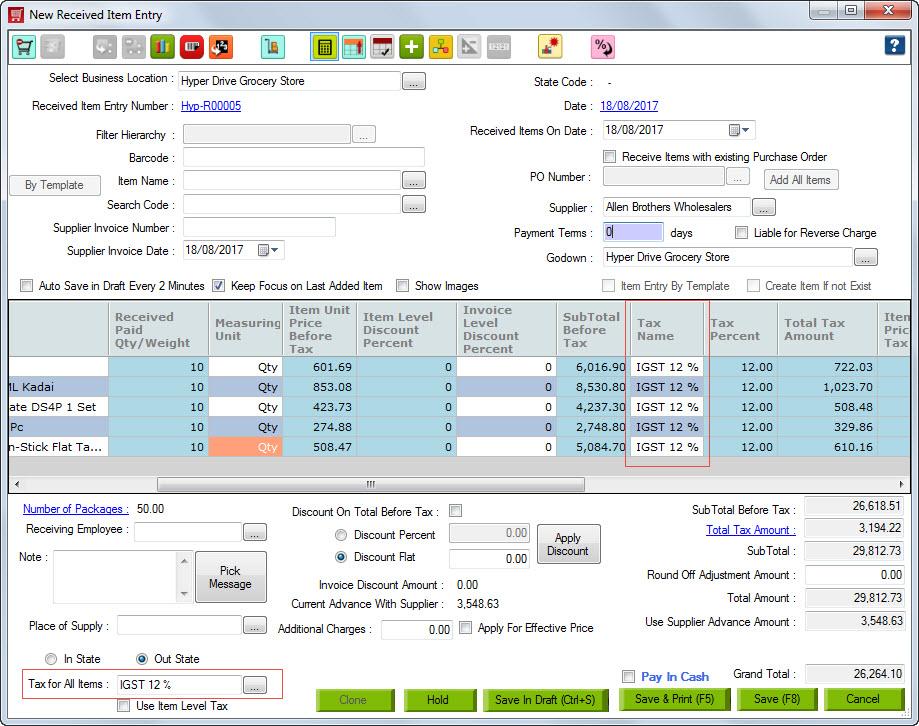

1 . Specifying single tax at Invoice level or Received item entry level.

If you are into a business where all your goods / services that you offer or purchase fall under a single tax percent bracket, you can use this option. With this option you will be able to specify single tax structure to be applied to all items in the invoice or purchase entry.

Note:: if you have specified that you are making out of state invoice and if the place of supply (State code) of your end customer and place of supply of your business location is the same than our application will warn you that you have specified wrongly that you are making an out state invoice when actually you are making instate invoice. If you have selected the warning label as described above, you will still be able to save invoice as out of state. Whereas if you had chosen error level than you would not be able to save this invoice.

Following are the points you need to consider while choosing this option of specifying single tax at invoice or purchase level.

- If you are always going to select tax at invoice or purchase level you will not need to specify item level taxes which could save you some time while adding new items in the system.

- This option relies on the operator to select the correct tax structure, which in the rush of invoicing can be error prone

- You cannot use this option if your invoice or purchase entry contains items that have different tax brackets under GST.

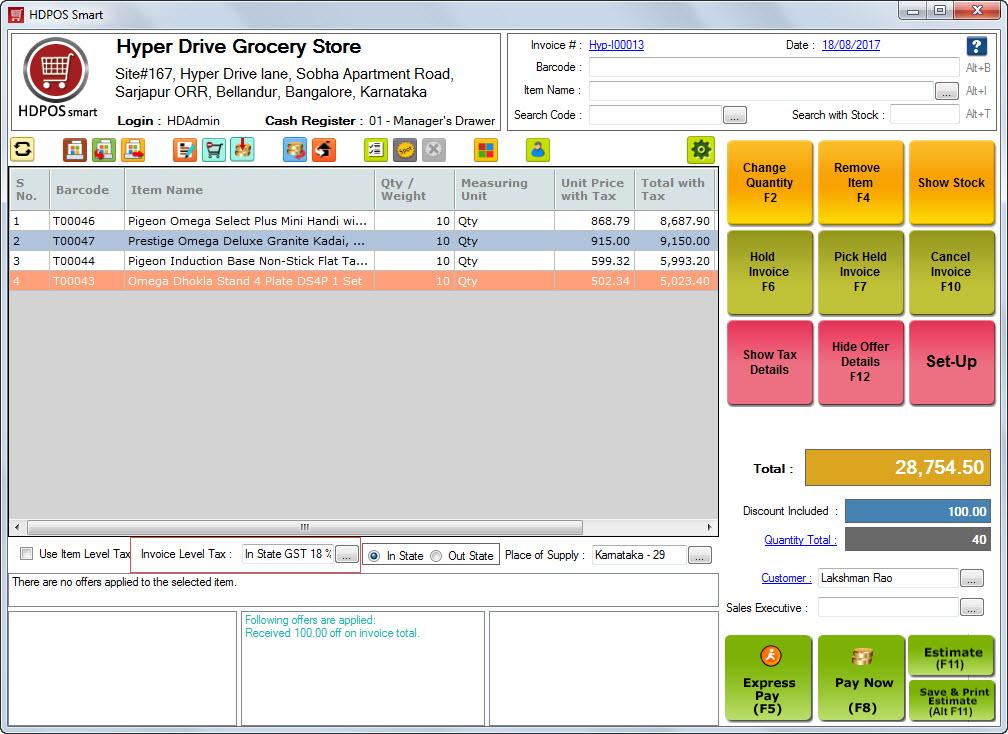

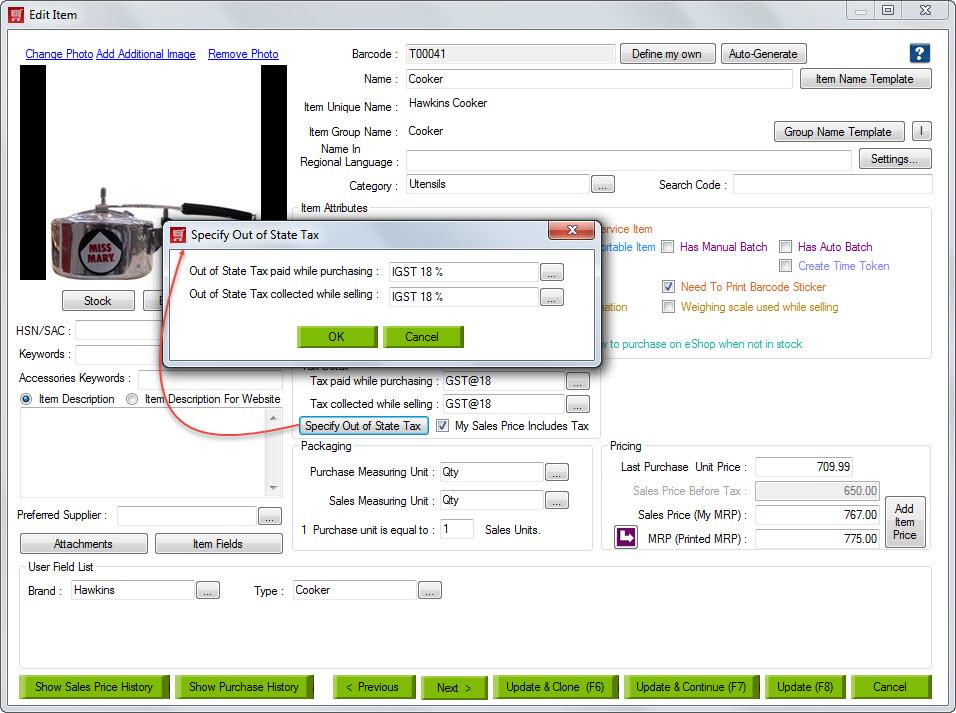

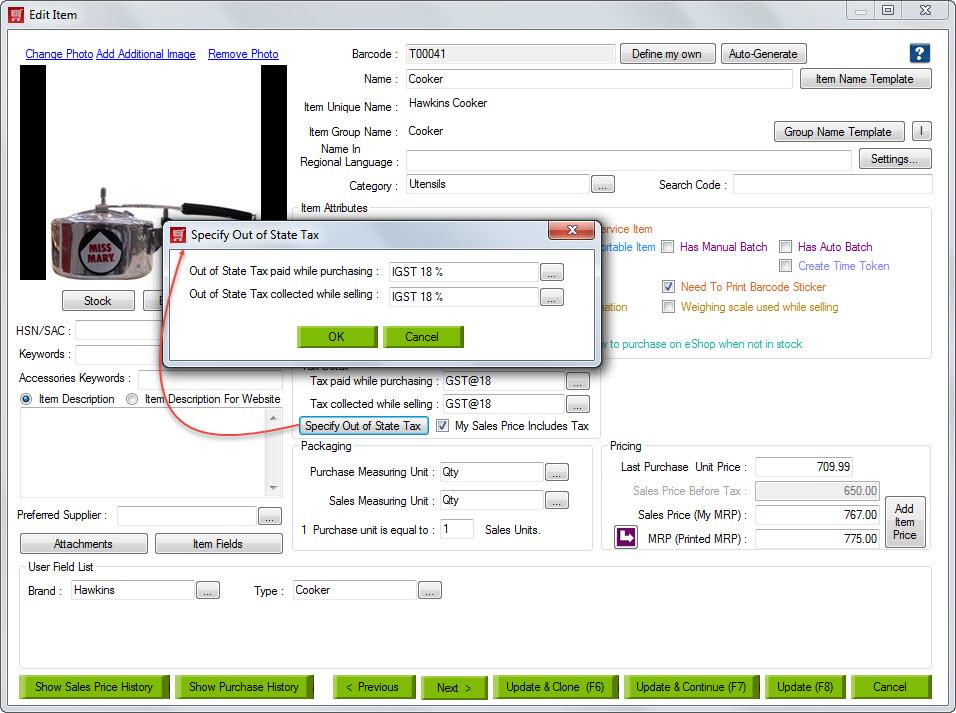

2 . Specifying In-state / Out-state tax structure for each item separately in Item details.

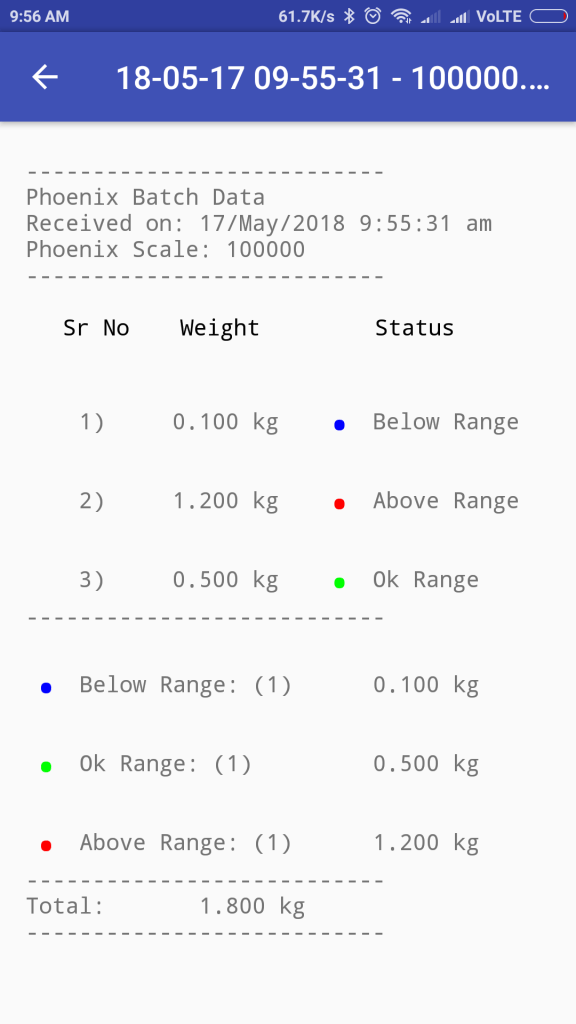

If you select this option you will need to specify instate sales and purchase tax structures as well as out of sales and purchase tax structures for each items at the master data level. When you select if you are making in-state / out of state invoice or purchase entry system will smartly apply appropriate tax structure for each item in that document and do the corresponding financial transaction entries.

Note:: if you select out of state tax for an invoice and you add an item for which you have not yet specified item level out of state tax, system will warn you of the missing tax.

Following are the points you need to consider while choosing this option of specifying in-state / out state tax at Item level.

- With this option you are in control at administrator level to attach correct taxes for each item. All the operator has to do is select if he / she is making in-state / invoice or purchase entry.

- Though it may seem little overwhelming to attach the correct taxes for each item in your inventory at first, in the long run it will help you reduce data entry errors.

Filing GST tax Returns

Under GST tax reforms government of India is making very convenient for a business to report their tax collection and file their tax returns. As of writing of these documents there are few tax return details that you will have to create in a spreadsheet format. Some of the details required on these spreadsheet fall out of the scope of our applications, but most of the information that you need is provided to you in the via various reports in the system.

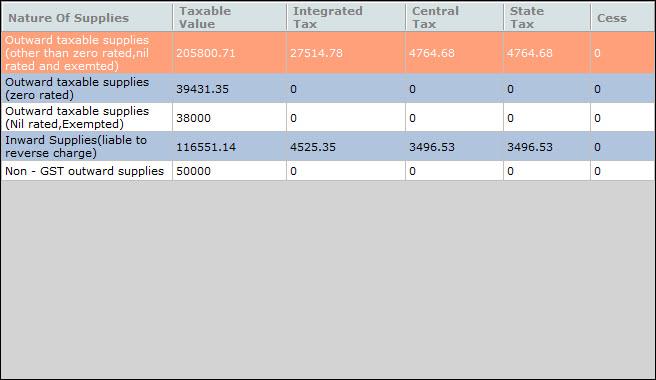

GSTR 3B

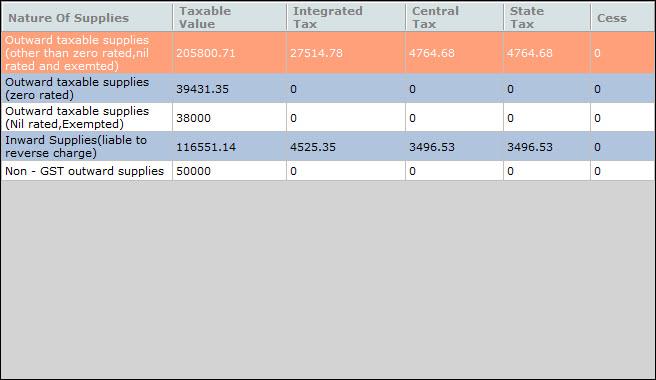

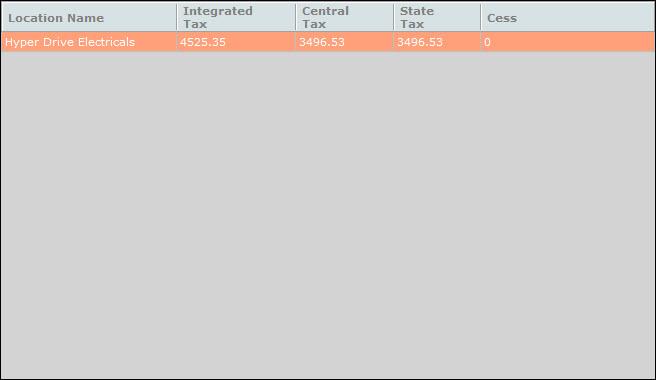

Following are the Reports you may need while filing GSTR 3B

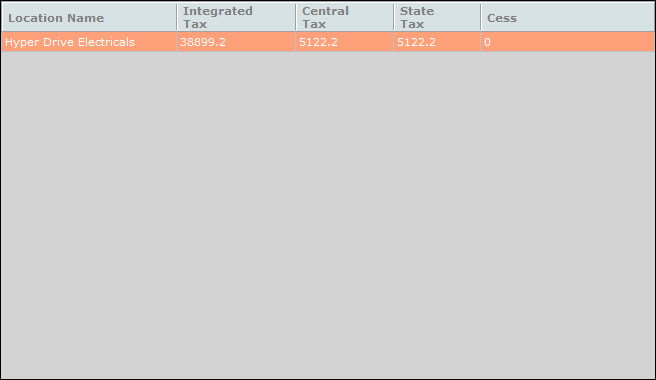

Outward Supplies and inward reverse charge

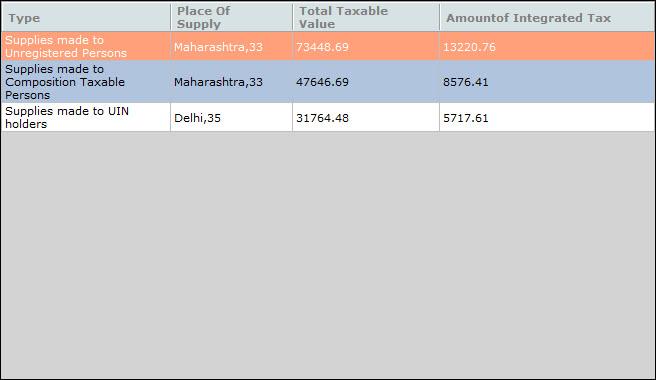

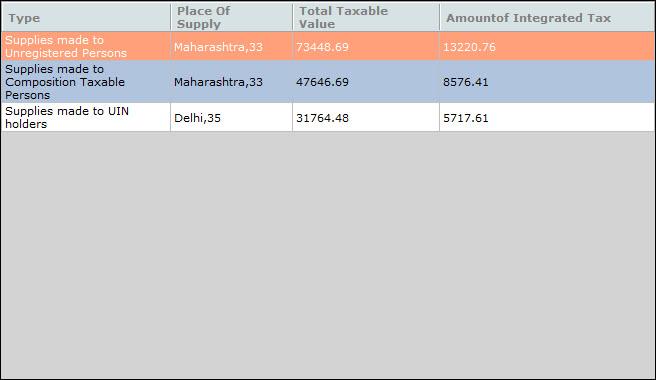

Inter State Supplies

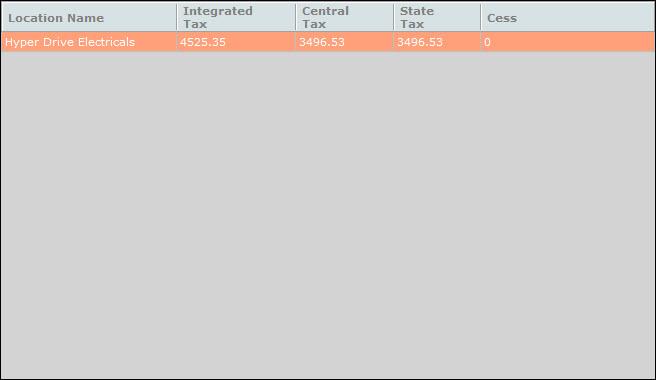

Purchases – For Reverse Charge – Summary

Purchases – No Reverse Charge – Summary